European Real Estate Outlook for 2018

Despite the geopolitical uncertainties looming in the year ahead, the outlook for European real estate remains positive with a broadly supportive economic backdrop and bullish market sentiment. Even Spain, one of the hardest hit European countries during the 2008 financial crisis, has come back strongly and is now seen as one of the stable investment bets in the region.

A number of institutional Finnish investors are betting on Germany as one of the winning locations and they are not alone. Transaction volumes in Germany overtook the UK for the first time in 2016 since 2012, due to the cooling down of the London market in particular. Thomas Barrack, CEO of US private equity company Colony Capital, and incidentally one of Trump’s key advisors, believes that Europe as a whole represents a big opportunity. Interestingly, his firm has also been targeting Germany, in particular Berlin, as well as markets such as Ireland.

For 2017, Hutchings sees room for prime yields in Western Europe to tighten by 30-40 bps while rents are set to rise by 2-3% across the board. Spain in particular is well positioned for the coming years, our Madrid briefing heard. Following its new-found political stability, the country is heading for a period of sustained and sustainable growth as it continues to move from being one of the most uncertain to the most stable market in Europe. As David Brush, chief investment officer of Merlin Properties, put it: ‘Spain is the adult in the room.’

Despite the many political and economic uncertainties clouding Europe’s future, the real estate industry is upbeat about most of its major markets. But Brexit is re-shaping the European real estate map.

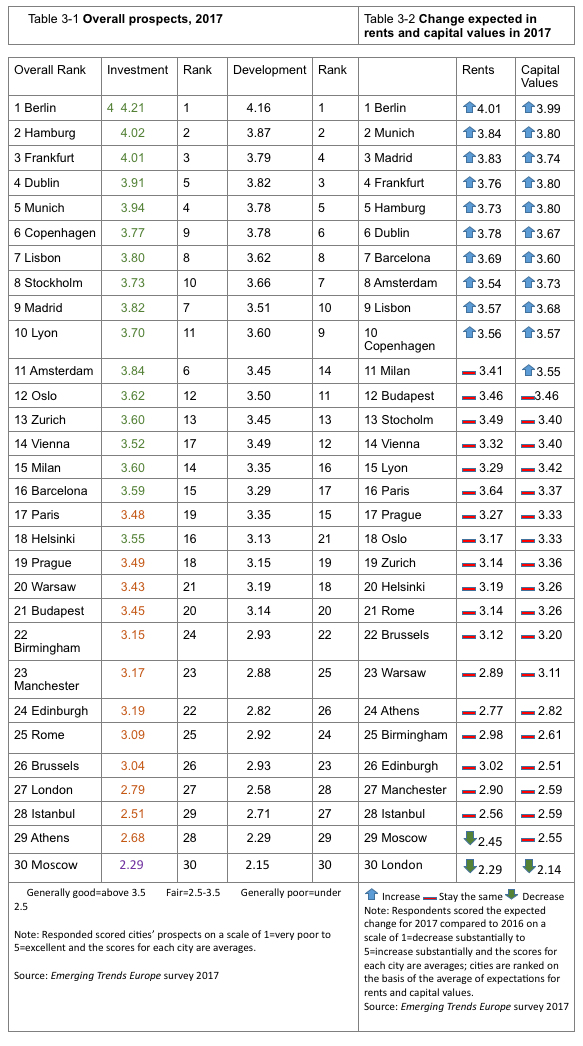

“Germany replaces the UK as Europe's Number 1 safe haven,” says a panEuropean investor. Berlin, Hamburg and Frankfurt occupy the top three places in Emerging Trends Europe’s league table, while Munich retains its appeal at Number 5. Berlin, the capital, once again takes gold; its position as a trendy and dynamic global gateway to Europe is now firmly established. "

Berlin is a big city where we see most growth over the next 10 years,” says an international player. Hamburg retains the silver, while Frankfurt, Germany’s business centre, has climbed sharply in popularity to take the bronze. Many of those interviewed by Emerging Trends Europe spotlight the latter’s potential attractiveness to the financial sector. “Frankfurt is the most obvious beneficiary of the Brexit decision.”

Conversely, Europe’s real estate industry has a sharply more negative view of the UK’s main markets, and London in particular. The UK capital now languishes fourth from bottom at Number 27, just ahead of Istanbul, Athens and Moscow. And the UK’s second-tier cities are also marked down. Birmingham – one of last year’s top 10 – has slumped to Number 22, with Manchester and Edinburgh just behind it.

However, this downgrade relates specifically to these cities’ prospects for 2017. Emerging Trends Europe’s survey was conducted almost immediately after the UK referendum decision to leave the European Union was announced: between July 1 and August 12, 2016. The result was unexpected, and Europe’s real estate industry was then – and still is – trying to analyse what impact Brexit will have. So, while some interviewees express concern and uncertainty about what it will mean for London and other UK cities in the longer term, others believe capital will continue to flow in.

Europe’s other big gateway for global capital, Paris, has not received an unqualified thumbs-up. Despite its undoubted appeal as a world city, it remains mid-table at Number 17. With the French economy still stuttering and an election looming in 2017, investors are cautious. There is also some scepticism about the city’s ability to benefit from Brexit; interviewees cite the high cost of employing people in Paris. “My big worry is that Paris doesn’t capitalise on this opportunity to position itself as the unique world city in Europe,” says the CEO of a French property company. But, as last year’s Emerging Trends Europe highlighted, market opportunities are now about cities rather than whole countries. “Cities matter; more and more people want to live in them. We are spending more time on next year’s cities – focus on transportation, infrastructure, education,” says another global playe

Investment prospects in 2017

Investment prospects in selected jurisdictions where Ketenci&Ketenci advises clients on real estate investments:

BERLIN (1)

Fashionable, youthful, fast-growing and under-supplied, the German capital tops the table again this year and scored highest on all four survey categories: investment, development, and prospects for rental and capital growth. A financier sums it up: “In Europe the major darling right now is Berlin.” The city is now established alongside London and Paris as a large, highly liquid real estate market with truly global appeal. “Berlin is a big city where we will see most growth over the next 10 years. It is the capital of Europe, and I can see it becoming the engine of Germany again,” argues an international fund manager. According to Real Capital Analytics, €3.9 billion was invested in the city in the first six months of 2016. “Berlin has those good urban themes: it is becoming a multicultural city whereas other German cities are very German. It is becoming a global city. People want to work there, there are multiple employment sectors active in the city, and tech is a very big thing there,” says an American investor. Business and population growth go hand in hand, so both offices and housing are hot markets. Prices are steep, but plenty of buyers are prepared to pay well for property in a rising market when growth is low elsewhere: “It’s better to accept higher prices and look at the places where there’s a chance for rental growth and income increases. In markets like Berlin we are seeing increasing rents.” Of all European cities, Berlin is probably the one where developers can operate with the fewest qualms. “We are developing speculatively where it is a no-brainer that we will find tenants. For a class A office building in Berlin these days you don’t need to have the tenant before,” says a German investor-developer.

FRANKFURT (3)

“The market in Frankfurt is rather euphoric at the moment,” says a European fund manager, and the buoyant mood has seen Germany’s financial capital rise 11 places to Number 3

Investors in the city have good reason to be optimistic. Frankfurt has gained a twofold benefit from the Brexit vote in the UK: not only is it perceived as a stable market in unsettled times, but a number of interviewees believe it could also provide an office destination for bankers relocating from the City of London. “Longer term, London will lose people as a result of Brexit and other cities will benefit. In financial services, it will be Frankfurt rather than Paris because the cost of employing people is so high in France,” predicts one fund manager. Some interviewees take a more sceptical view. “If Deutsche Bank left London it has enough space in Frankfurt that you probably wouldn’t see the effect on the market,” says a German investor. “Banks are not going to move to Frankfurt,” asserts another. The city’s current and future success is heavily dependent on its financial services and banking businesses, and there are some questions over these. Germany is over-banked; it has a huge number of domestic players – 1,700, a third of the total number of banks in the EU. “The question will be how the rationalisation of large retail banking operations affects Frankfurt? The banks are closing hundreds of branches in Germany,” says a local investor. “If that leads to more centralisation that would be good for Frankfurt, or there could be a reduction in headcount.” While yields for prime office investments have compressed to a record low of 4.2 percent, office vacancy at near 12 percent is a continuing deterrent to speculative development. “I would never touch a square metre of development in Frankfurt without having it let,” says a German developer. “Tenants can shop around. You have to be really careful what you’re developing.”

DUBLIN (4)

Dublin has slipped one place to Number 4, reflecting a slight cooling of sentiment although as one local investor declares: “The single biggest issue is how our market in Ireland fares in the context of Brexit.” On the whole the perception is that, if anything, Dublin will be a beneficiary of Brexit. One private equity investor says: “We don’t think Dublin picks up financial services headquarters, but it will pick up back-office functions and is not a huge market so any gains can have a big effect.” This is combined with residential and commercial markets that do not offer the bargains of two or three years ago but which should be sustained by continued economic growth – predicted to be 4.9 percent for Ireland in 2016 – and foreign direct investment. However, there is a Brexit counter-point: “If there is a recession in Britain, that will impact on the Irish domestic economy, especially those sectors that are dependent on the UK such as tourism and agriculture. The UK could be replaced by other markets, but that would hit some areas of real estate.” One domestic investor observes: “The amount of capital coming into the market has already started to slow, but that is compared to an unprecedented amount of activity in 2013, 2014, and 2015 especially for a market of our size. The faster money is moving on to pastures new, and more patient money is replacing it.”

LISBON (7)

Lisbon has rocketed into the Emerging Trends Europe top 10 primarily due to its status as a recovering market – and one that is still seen as having plenty more room for growth. Both opportunity funds and core investors are able to find assets in a city where yields are higher than in other European capitals, and there is potential for good returns if they are prepared to accept some risk. “We have not yet got to the same yields as the previous peak, even though volumes are higher, and if the economic context remains stable or strong then arguably there is further compression to go. It could get to the old levels of 2007 and 2008,” says one adviser. “We just haven’t seen the transactions and the evidence to support that yet, but there are some going on at the moment.” There appears a good balance in terms of opportunities, with one investor stating: “The best business opportunities are found in the retail and logistics market due to the expected growth of rental income.” But others suggest offices as the best bet because of a lack of grade A space, albeit that development is still seen as too risky. Another adviser observes that the market for secondary or tertiary assets remains weak: “People want good quality, prime not secondary assets.” And there are worries that economic growth is fragile and Portugal’s time “in vogue” can end suddenly. “When the tide changes, liquidity leaves Portugal very quickly,” one investor says. Right now, equity remains more plentiful than debt, and there is a widespread view that the debt market is not yet fully functioning. As one investor concludes: “If you look at the retail sector the biggest buyers are property companies that have a low cost of capital and funds that are only looking for about 30 percent loan-to-value. Any lack of finance may influence things at the opportunity fund end of the scale.

MADRID (9)

Madrid keeps its place in the top 10 European cities for investment and development. The high ranking is justified by the strong belief that the city will continue to attract global capital while domestic lenders and buyers have increasing levels of capital to deploy. There are also expectations of good rental growth as the Spanish economy continues to recover, and a slight but nonetheless appealing yield premium compared with other European capitals. “Madrid is the third European city regarding the real estate markets and targets,” says one global investor, while another value-add fund manager says: “If you search well, there are some exciting opportunities because you still have a bit of the distress from the previous cycle.” Residential undersupply provides a good opportunity: “We’ve been pretty positive buyers,” says one opportunity fund manager, “playing it by accessing the housing market where there is an imbalance of capital and supply.” But there is also a perception that real estate here, particularly prime, may have become overpriced, meaning more risk has to be taken on to find adequate returns. “We want to invest more but there are a lot of expectations from vendors, and it is hard to find product,” says one fund manager. “There are expectations of rental increases, but it is very difficult to find the right product.” “It is still throwing up opportunities, but it’s extremely competitive, so you have to buy land positions or busted housing deals, things that require a lot more risk,” adds another cross-border investor. That said, some opportunity and value-add funds are reconsidering Madrid after eschewing this competitive market in the past few years. “We think we may go back into Spain next year, which we felt had got too expensive,” says one, echoing a common sentiment. “We see signs that more realism is coming back into the investment market there.”

MILAN (15)

The fact that Milan has slipped three places to a middle ranking Number 15 reflects the political and economic headwinds that affect Italy in general. A constitutional referendum, due in late 2016, could turn out to be a protest vote from a disaffected Italian public. “People might vote against Prime Minister Matteo Renzi, especially against the recent backdrop of political situations in other countries,” says one private equity investor. And the banking sector remains illiquid, heavily burdened by non-performing loans. “Italian banks are still suffering the effects of the recent financial crisis and, thus, are hardly available to provide additional capital for real estate,” says one local investor. But Milan nonetheless benefits from “not being part of Italy”, as one global fund manager puts it. It is also in the throes of a major makeover, with new urban districts like Porta Nuova and CityLife springing up on brownfield and redundant industrial sites. “Milan is the most interesting city in terms of real estate development and income,” says one pan-European fund manager. “It has the same good fundamentals as Madrid, Barcelona or Hamburg, but property prices are lower.” “For offices we believe that Dublin, Madrid, Barcelona and Milan are still below their long-term intrinsic value and therefore constitute attractive investment markets,” says another pan-European buyer. As an office market, Milan is perceived as, “further behind, so we can see strong rental growth coming through”. This growth, while not fantastic, is being precipitated by improving infrastructure and a moderate uptick in demand. “The city of Milan is one of the few that offers growth prospects due to the recent Expo that has determined new investments and new developments, combined with the project of new subway lines,” says one domestic investor. “Several companies located in Milan have started research for new headquarters,” adds another. However, the market is split between opportunity funds and core investors, with the middle ground yet to spring back to life. “It seems that investment funds and operators’ investment strategies are either high-risk transactions where a 25 percent return is required or prime transactions with 4 percent return guarantees. Transactions and opportunities in the ‘middle’ do not appear to be interesting,” says a domestic fund manag

LONDON (27)

Number 27 is an extraordinarily low ranking for Europe’s largest and most liquid real estate market, but London’s fall of 16 places speaks volumes about the potency of the Brexit effect. It is clear, though, that the market’s sudden frostiness towards the UK capital owes less to doubts about its long-term position as the pre-eminent European property investment market than it does to short-term expectations about prices and rental growth post-referendum. Many interviewees expect prices to fall, but few expect them to collapse: “Prime London assets have seen a 50 to 75 basis points yield reduction after Brexit, but that normalised at the end of July,” says one investor. “We expect a correction of 10 to 20 percent in the UK depending on the location with London more affected than elsewhere,” predicts another. Some sectors and locations are expected to be affected more than others. “I do think in London the space where we could see a lot of distress is high-end residential. You have all these large developments where sales rates are slowing and a lot of the people who provided finance for these guys are applying pressure to sell.” Retail will hold up better, suggests a local investor: “The West End is pretty insulated and, if anything, the weak currency has led to increased footfall from abroad.” In the short term, Brexit will dampen expectations of rental growth in the office market: “Occupiers certainly won’t rush in and pay the sort of rents that they were paying pre-Brexit, as they don’t want to risk looking naïve.” In the long-term, much will depend on whether occupiers decide to move employees out of London to EU cities. “Banks and other firms will probably leave the City of London, and that is why that market is hard to invest in at the moment,” is a common opinion. On the other hand, some investors believe that there will be better opportunities for acquisitions: “In this market if you have the funds you should actually buy more now. It is an anti-cyclical approach, but it is the right time.” The referendum has already put the brakes on development in London, but most interviewees expect the characteristics that have made the city so successful to endure. “I find it very hard to see a reason why London won’t continue to be the number one city in the world,” says a US investor. “It is a place where people want to live and work, and I think capital will continue to flow there.”

ISTANBUL (28)

Istanbul has plummeted 19 places to Number 28 in the Emerging Trends Europe rankings, with investors citing deadly terrorist attacks and a failed political coup as reasons to avoid the city. “Until recently the market had started to recover from the attacks in March but the attack on Ataturk airport [in June, during which 45 people were killed and 230 injured] and the failed coup will have a negative impact,” says one private equity investor based in the city. “People are braced for further terrorist attacks but a coup is not something that people have thought about.” This is undoubtedly deterring international investment. “It is fair to say the prospects will be worse from now until the end of the year,” says one investor. “There could be investors from the Middle East who will not be deterred, but in the short term it is less institutional investors, it’s more single investors and high net worth individuals chasing deals but not in a sophisticated or coordinated manner.” This is stymying what should be a blossoming market, with positive demographic trends and plenty of domestic capital targeting the sector. “Turkey is a country of 78 million people which is growing fast and 50 percent of the population under 30. There is a growing middle-class with good incomes, and young people are transforming into young professionals so anything focused on consumer spending will continue to improve,” says one developer. “Turkey has always been a country with a huge liquid local market for real estate, and that won’t change. So it has been a big beneficiary compared to markets like Russia, which are dependent on foreign capital, and I don’t foresee any change on that side,” says another investor. A strong banking sector is another strength, while there is the likelihood of increased government economic stimuli, post-coup. In terms of markets that look positive, student housing is consistently cited by domestic interviewees, as the growing middle classes send their daughters and sons to university. “No matter what is going on students have to go to school, and there are no large facilities of good modern standards in this country or in Istanbul, so there is a good balance of supply and demand.” But until stability returns to Turkey, international investors are steering clear of Istanbul.

Sources: PWC Emerging Trends in Real Estate in Europe, 2017